Featured

Table of Contents

The therapist will examine your funds with you to determine if the program is the right alternative. The testimonial will include an appearance at your monthly revenue and expenses. The agency will certainly pull a credit score report to comprehend what you owe and the extent of your hardship. If the mercy program is the most effective remedy, the counselor will send you an arrangement that information the strategy, including the quantity of the month-to-month payment.

If you miss out on a settlement, the contract is nullified, and you must exit the program. If you assume it's a great choice for you, call a therapist at a nonprofit credit report therapy firm like InCharge Debt Solutions, that can address your questions and assist you determine if you certify.

Due to the fact that the program allows consumers to opt for less than what they owe, the creditors that take part want confidence that those who take advantage of it would not be able to pay the full amount. Your credit card accounts also must be from financial institutions and credit report card business that have agreed to get involved.

Equilibrium needs to be at least $1,000.Agreed-the equilibrium should be settled in 36 months. There are no extensions. If you miss a repayment that's just one missed out on settlement the arrangement is terminated. Your lender(s) will cancel the plan and your equilibrium goes back to the original quantity, minus what you have actually paid while in the program.

Top Guidelines Of Non-Profit Relief Organizations Reviewed

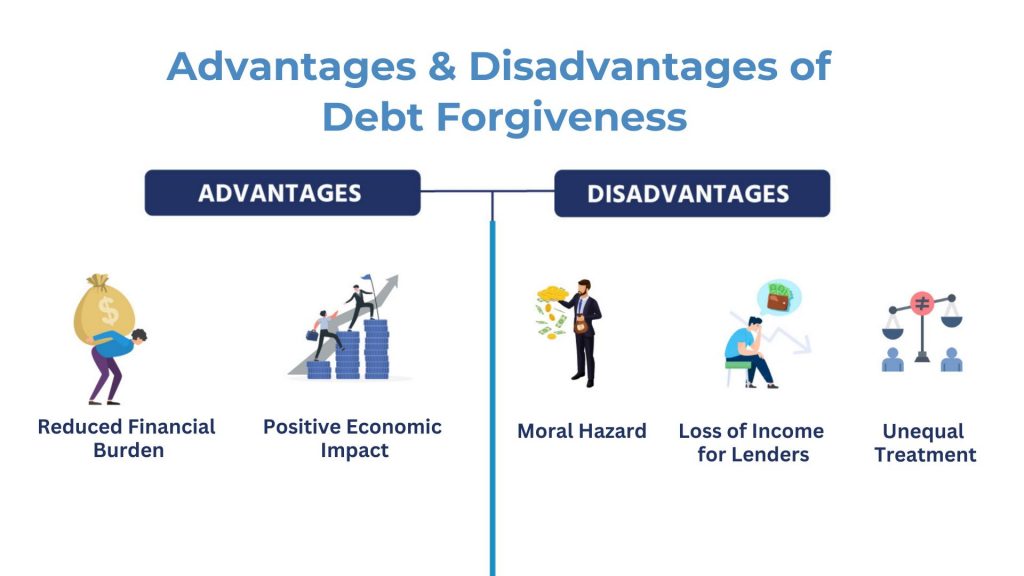

With the mercy program, the lender can instead select to maintain your debt on the books and recoup 50%-60% of what they are owed. Nonprofit Bank Card Debt Mercy and for-profit financial obligation settlement are comparable because they both give a method to settle credit history card debt by paying much less than what is owed.

Bank card mercy is designed to set you back the consumer much less, pay off the financial obligation quicker, and have fewer downsides than its for-profit equivalent. Some crucial locations of difference in between Bank card Financial debt Mercy and for-profit financial obligation settlement are: Bank card Financial debt Mercy programs have partnerships with creditors who have accepted get involved.

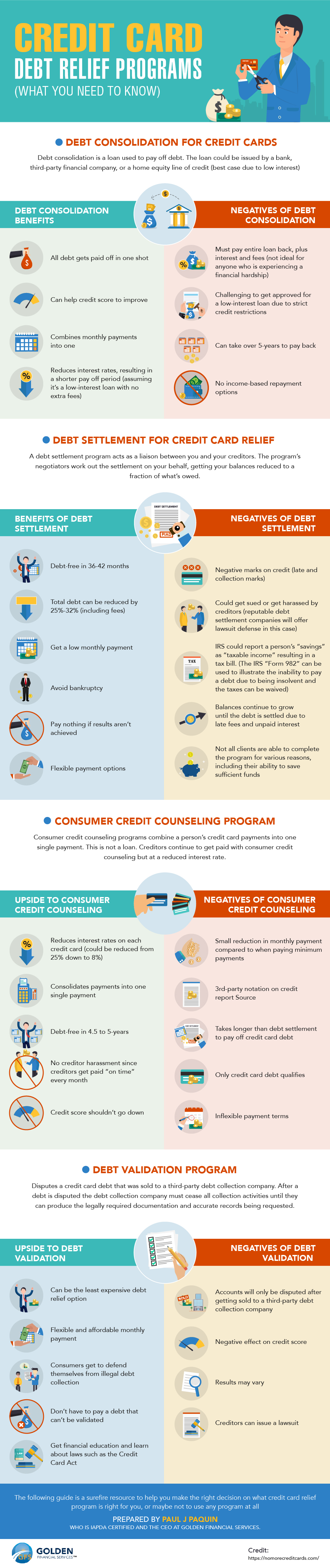

Once they do, the payback period begins right away. For-profit financial debt settlement programs negotiate with each financial institution, normally over a 2-3-year duration, while rate of interest, costs and calls from financial obligation collectors proceed. This implies a larger hit on your credit rating report and credit rating, and a raising balance till arrangement is finished.

Charge Card Financial debt Mercy customers make 36 equivalent regular monthly repayments to eliminate their debt. The payments go to the creditors until the agreed-to equilibrium is gotten rid of. No rate of interest is charged throughout that duration. For-profit financial debt negotiation customers pay into an escrow account over an arrangement period toward a round figure that will certainly be paid to lenders.

The Regulatory Considerations Regarding Debt Forgiveness Statements

During this moment, fees may boost, and rate of interest accrues, so settlements might end up not being cost effective for customers. Meanwhile, clients quit making settlements to their bank card accounts. Phone calls from financial obligation collection agencies continue and creditor-reported non-payments remain to harm the client's credit score record. Registration in a Charge Card Debt Mercy quits calls and letters from financial obligation collection and healing companies for the accounts included in the program.

For-profit financial obligation settlement programs don't quit collection activities until the lump-sum repayment is made to the creditor. Nonprofit Credit History Card Debt Mercy programs will certainly inform you up front what the regular monthly charge is, topped at $75, or less, depending on what state you stay in. For-profit debt negotiation companies may not be clear about charge quantities, which commonly are a portion of the equilibrium.

The Of Policy Changes Influencing Bankruptcy Availability

For-profit debt negotiation likely will hurt it more, because you will not be paying creditors during the 2-3 year negotiation/escrow duration, yet they have not accepted a plan or obtained any kind of money, so they're still reporting nonpayment. This gets on top of the credit report hit from not paying the sum total.

In many cases, financial obligation combination also comes with a reduced interest rate than what you were paying on your debt cards, making the monthly expenses, as well as general prices, much less. Charge card financial debt combination's most typical kinds are financial debt management plans, financial obligation combination loans, or a zero-interest transfer credit history card.

To get a debt loan consolidation funding or a zero-interest equilibrium transfer credit card, you require a credit history of at the very least 680. Greater. If your accounts are charged off, your credit report is likely well below that. Credit scores rating isn't a factor for debt management program, however you need a sufficient earnings to be able to make a regular monthly payment that will cover all of the accounts consisted of in the program.

Insolvency is the last resort for somebody who has more financial debt than they can pay. It can be the step you take in order to prevent bankruptcy.

The Single Strategy To Use For What to Watch For While Selecting a Bankruptcy Provider

Insolvency will eliminate all qualified unsafe financial debt. Debt Card Financial debt Mercy will have an adverse impact on your credit report score considering that full equilibriums on accounts were not paid.

Credit Report Card Financial debt Forgiveness settlements begin as quickly as you're approved into the program. Collection actions and claims on Credit scores Card Financial obligation Mercy clients are stopped as soon as lenders agree to the plan.

Table of Contents

Latest Posts

Things about Is Virtual Wallets and Mobile Payments: Your Complete Guide to Digital Financial Security : APFSC Work for Your Case

Key Things to Ask a Bankruptcy Counseling Service for Dummies

Some Known Incorrect Statements About Practical Tips to Restore Your Finances

More

Latest Posts

Key Things to Ask a Bankruptcy Counseling Service for Dummies

Some Known Incorrect Statements About Practical Tips to Restore Your Finances